Remember the proverb - early bird gets the worm. This childhood proverb fits right for early investors. Early investments have many benefits like having financial stability at an early age, higher returns opportunities and ability to achieve financial independence before time.

Let’s discuss the benefits of early investments in details.

#1. Retire Early

One of the best benefits of starting investing early is that you can plan early retirement. Most of us hate our routine job and don’t want to spend the whole life in following the same schedule.

Now the question is how early investments will retire you early?

The answer lies in compounding interest that I am gonna explain in the next section.

Remember, the money invested works for you and generates more money passively.

Do you know the snowball effect?

The Snowball effect is a process that starts from an initial state of small significance and builds upon itself with time, becoming larger and (maybe) disastrous.

The same phenomenon works for your investments. Starting early begins the compounding process early that results in reaching your financial goals in advance.

#2. Compound interest makes the difference

Let’s discuss the importance of compounding interest in wealth creation.

Compounding means an increase in the investment amount because of the interest earned on the principal amount, as well as the interest accumulated during the invested period.

This example will help you understand better.

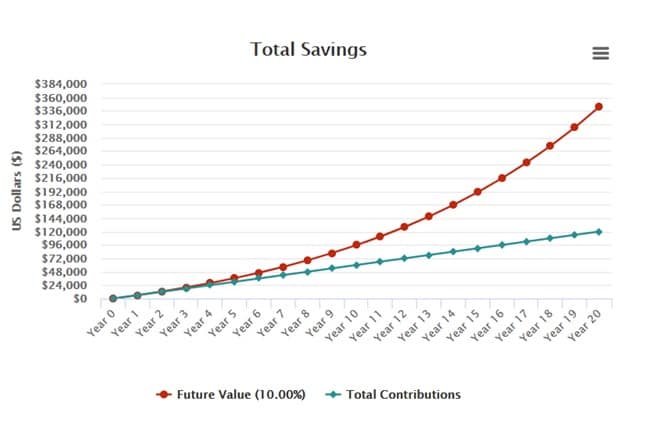

If you're 25 and you are saving $500 a month for the next 20 years (to retire at 45), assuming a 10% annual interest rate, net worth you are having after 20 years would be $343,650. And you know, how much you have to invest - $1,20,000.

See the chart below.

That’s the power of compounding.

Your net worth would vary depending on the investment amount you increase with time and the returns you get over it.

#3. Time advantage

If you are thinking that you don’t have thousands of dollars to invest every month, then you have a bigger weapon in your arsenal and that is TIME.

This is another advantage of starting investing early. You can begin with a small amount and still, you can reach a meaningful financial goal because your money will have more time to work and get accumulated.

Let’s understand this with an example.

If you're 25 and you are saving $500 a month for the next 20 years (to retire at 45), assuming a 10% annual interest rate, net worth you are having after 20 years would be $343,650.

On the other hand, if you start investing $1000 at the age of 35 your net corpus at 45 would be $191,249

You could earn an extra $152,401 by starting at an early age with a low investment amount. You can see the difference.

#4. Take more risks

If you want high yields on your money, you have to invest in risky segments. The more would be the risk, higher could be the gains.

If you are in your 40s, having a spouse and kids, you can’t take much risk of money loss. Afterall, you have to your monthly bills, you can’t ignore that as well. That results in getting lesser returns because you can’t put your money into risky investments.

On the other hand, if you are in your 20s, you can afford to take more risks and produce high returns. You would have the time to recover if something goes wrong. You can invest in stocks or you can learn the process to start Intraday trading to get huge returns.

But this thing can only happen if you have enough time to recover. A later investor would be more cautious about investing their money.

#5. Step Ahead Of Others

Earlier you start to invest, better would be your financial health in later years of life. As per the report, only 39% of people start investing in their 20s in the United States. You can be ahead of the rest of 61% and get financial stability in advance.

You would be able to afford more things with better finances that others can’t who have chosen to invest in the later age of their lives.

You would also be able to face hardships if your regular income becomes unstable because you would have money accumulated that will provide a financial cushion in such a phase of life.

Bottom Line

Early investments will not only help you retire early but those can also provide an income stream throughout life. Many investments like dividend stocks give you a steady income.

Early investments also help you get opportunities to diversify your investments and beat the inflation rate.

I am a blogger and writer

Post new comment

Please Register or Login to post new comment.